Denver Post via Getty

Welcome to Insider Cannabis, our weekly newsletter where we’re bringing you an inside look at the deals, trends, and personalities driving the multibillion-dollar global cannabis boom.

Sign up here to get it in your inbox every week.

Happy Friday readers,

This week was dominated by the news that New Jersey finally legalized cannabis, months after over two-thirds of New Jerseyans voted to legalize.

The state's difficulty in passing overwhelmingly popular legislation offers a cautionary tale to other states that are hoping to legalize to pave over budget deficits and spur criminal justice reform. It's a lot easier said than done. And it may take years to actually see the promised tax revenue from a fully established cannabis market.

In other news, there was a flurry of deals in the cannabis sector this week. Yeji and I have a look at what that means for New York - a key market for cannabis companies - as well as what that means for the US more generally.

We don't have a crystal ball, but we outlined some specific acquisition targets in our story. We're already being proven correct.

Last, I moderated a pair of panels at Benzinga's Cannabis Capital Conference with Louie Reformina, of Turing Points Brands, and Andrew Thut, of 4Front. We touched on a number of issues including M&A trends in cannabis, ironing out the kinks of state legalization, and more.

Let's hit it.

-Jeremy (@jfberke) and Yeji (@jesse_yeji)

Here's what we wrote about this week:

New York is pushing to legalize marijuana. Here are the prime acquisition targets and the types of deals you can expect.

As New York lawmakers push hard to legalize cannabis this year, cannabis companies are eyeing acquisitions as a way to enter the state. Experts told Insider that private companies and struggling MSOs looking to sell off assets to stabilize their balance sheets, are likely to be acquisition targets.

The world's largest cannabis companies are jockeying to dominate the lucrative US market. 7 top CEOs and executives break down the deals you can expect.

The US cannabis industry is set for a flurry of deals as Democrats on Capitol Hill make cannabis reform a core issue and new state markets open. Insider spoke with CEOs and execs at seven of the top US and Canadian cannabis companies who said they're focused on expanding to dominate the lucrative US market.

Meet the 13 power players shaping the future of New Jersey's potentially $1 billion market for recreational marijuana

Governor Phil Murphy signed legislation to legalize cannabis in the Garden State on Monday. Meet the 13 power players, from lawmakers to executives, shaping the future of New Jersey's cannabis industry.

New York cannabis M&A is already heating up

Struggling cannabis companies with licenses in New York are likely acquisition targets. Ascend Wellness said it would take a majority stake in MedMen's New York assets.

There may be other deals to come as New York moves toward cannabis legalization

Executive Moves

- Terry Booth, the former CEO of Aurora Cannabis, will be taking over as CEO of Australis Capital.

- Clever Leaves announced that Hank Hague would be joining the company as chief financial officer

- Acreage Holdings announced that CFO Glen Leibowitz is leaving the company. Steve Goertz, former CFO of sgsco and a partner at Bespoke Capital Partners, will be taking over as CFO starting April 2.

- Agrify announced the formation of its new advisory board on Wednesday, including Rosie Mattio, CEO of MATTIO Communications, and Matthew Kressy, founding director of the MIT Integrated Design & Management program.

- Fyllo announced it would be bringing on Twitter veteran Katie Ford as the company's new COO.

- New Jersey has filled the remaining spots on its Cannabis Regulatory Commission, including Maria Del Cid, director of policy at New Jersey Department of Health, William Wallace of the United Food and Commercial Workers International Union, and Sam Delgado a former VP at Verizon.

Deals, launches, and IPOs

- Ascend Wellness Holdings announced on Thursday that it is investing $73 million in MedMen's New York assets, pending state approval. Read our story from this week where we outlined why MedMen's New York assets are a potential acquisition target.

- Acreage Holdings announced it would sell its Florida operations to Red White & Bloom Brands for $60 million in a cash and stock deal.

- Indus Holdings is acquiring Lowell Herb Co., for $39 million in cash and stock. The combined company will operate under the name Lowell Farms Inc.

- Parallel, the cannabis company run by Beau Wrigley, Jr., went public on Tuesday via a combination with Ceres Acquisition Corp., a cannabis SPAC. The transaction values the combined company at $1.84 billion. Read our story about the hot cannabis SPAC market.

- Verano Holdings Corp. announced that it raised C$100 million in a private placement. The company also announced this week an acquisition that would expand the company's footprint in Arizona to four dispensaries.

- Green Thumb Industries raised $56 million through a sale of subordinate voting shares.

- Cannabis packaging company KushCo raised $40 million in a direct stock offering.

- The Rainbow Real Estate Group raised $47 million to target real estate in areas where cannabis is legal for recreational and medical use. The round included $10 million from CrowdStreet, a crowdsourced investing platform.

- GrowGeneration continues its acquisition tear, this week scooping up a chain of four hydroponics centers in the San Diego area for $10 million.

- The Scotts Miracle-Gro Foundation announced on Monday it launched a new $2.5 million fund to "spark social change and help address the racial injustice and systemic inequality related to the enforcement of existing cannabis laws in the United States," with Hawthorne Gardening Company.

- Terra Vera, an ag-tech company focused on the cannabis industry, closed a $2 million seed funding round led by Will Raap, the founder of Gardener's Supply Company.

Policy moves

- New Jersey officially legalized cannabis on Monday after Governor Phil Murphy signed legislation that he and lawmakers had been negotiating for weeks. Read our list of the top power players of New Jersey cannabis.

- State lawmakers in Maryland this week proposed a plan to legalize and tax the sale of cannabis in the state, The Baltimore Sun reports.

- Morocco is legalizing cannabis production for medical use, Reuter reports.

- President Biden's attorney general nomination Merrick Garland said federal law enforcement officials should not go after those who are complying with laws in states that have legalized cannabis.

Science and research

- A new report from the National Bureau of Economic Research found that legalized marijuana is associated with a decline in worker's compensation claims.

- A new report from the Resource Innovation Institute and Berkeley Cannabis Research Center in conjunction with New Frontier Data found that illegal cannabis crops accounted for 83% of the overall industry's water use in 2020. The report's authors expect that to decline to 69% by 2025, but that the illicit market will be the primary driver of the industry's water use.

Earnings roundup

- The Valens Company released its fiscal Q4 earnings on Wednesday, reporting adjusted EBITDA of C$4.3 million for Q4.

- Innovative Industrial Properties released its Q4 and full year 2020 results on Wednesday, reporting $37.1 million in revenue for the quarter, and $21 million in net income.

- Cronos released its 2020 Q4 and full year results on Friday, reporting an adjusted EBITDA loss of $53.1 million in Q4 and losses of $147.3 million for the year.

- Next week EnWave, Indus, High Tide, and 48North will report earnings.

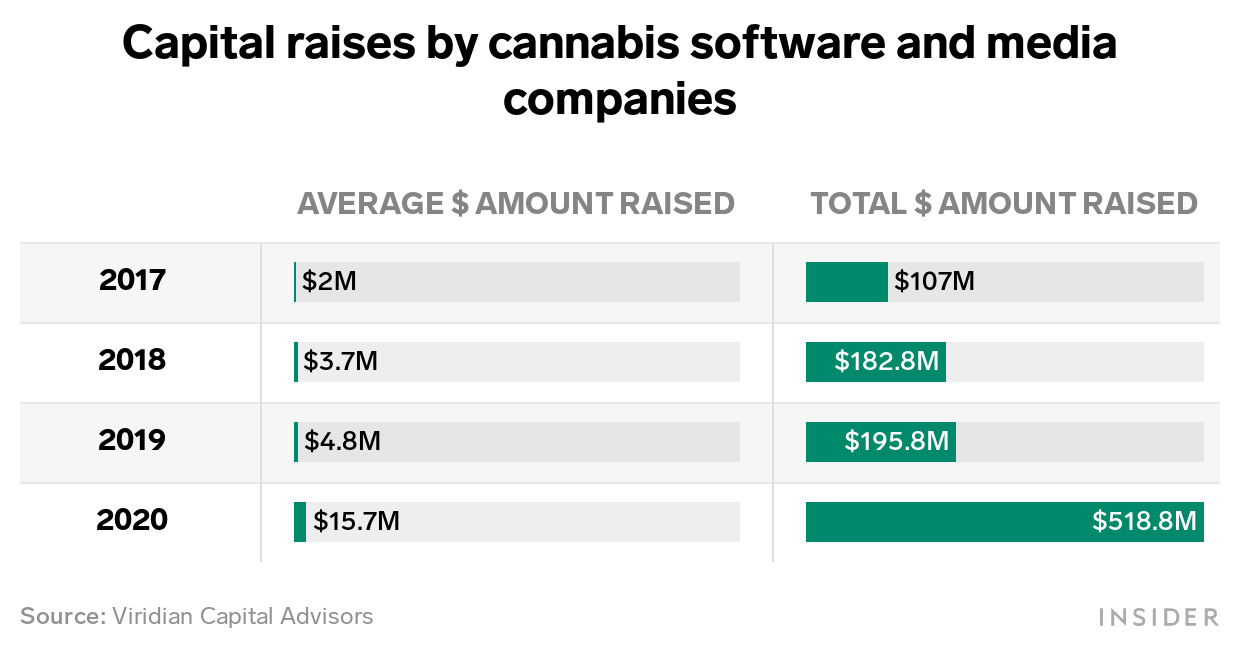

Chart of the week

Cannabis software and media companies raised $518.8 million in 2020, according to Viridian Capital Advisors, more than double what they raised in 2019. Read our story about the cannabis tech boom last year.

What we're reading

Billionaire Beau Wrigley Says His Cannabis Company Will Be Bigger Than The Family Candy Business (Forbes)

Opinion: Legalizing Marijuana The Right Way (Gotham Gazette)

Teen Use, Mental Health Spur Talk of Pot Curbs (Bloomberg)

Powerful House Dem bought cannabis stocks after pushing decriminalization (Fox Business)